[SMM Analysis] Significant Inventory Buildup During the Holiday, Post-Holiday Demand Recovery Falls Short of Expectations

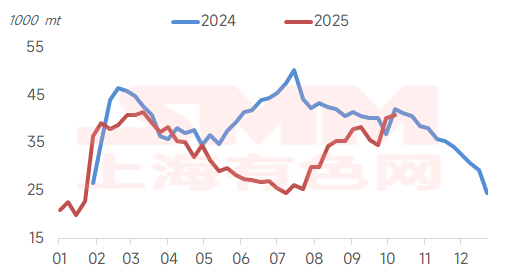

According to the SMM survey, this week, the SMM broad-gauge inventory of HRC in Ningbo stood at 410,000 mt (as of October 15), up 6,000 mt WoW.

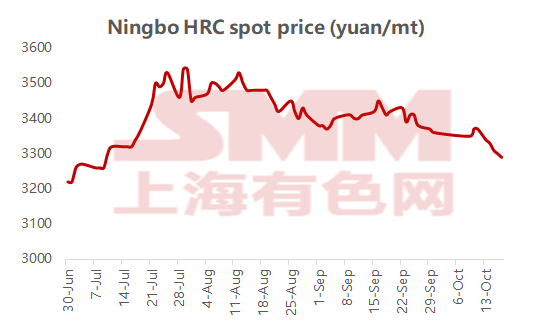

This week, HRC prices were in the doldrums, with spot prices falling by 50-100 yuan/mt on a weekly basis. The market trading atmosphere remained moderate during the week, with end-users restocking on an as-needed basis. By the afternoon close on October 17, the most-traded HRC 2601 futures contract settled at 3,204 yuan/mt.

Meanwhile, according to the SMM survey, in the Ningbo spot trading market this week, in terms of prices, the transaction prices of mainstream HRC resources were in the doldrums. By the afternoon of October 17, the closing spot offers stood at 3,280-3,290 yuan/mt. Prices remained in the doldrums during the week, but compared to 3,370 yuan/mt last Friday, the decline was significant, with prices falling by 80-90 yuan/mt. In terms of transactions, trading was mixed during the week. In the first half of the week, due to the recent resumption of work, downstream restocking sentiment was slightly stronger, and low-priced sales were moderate. In the second half of the week, futures were in the doldrums, market sentiment pulled back significantly, and trading deteriorated. In terms of arrivals, the shipping pace of mainstream resources remained stable, with a 7.6 discount for plain carbon in October, representing a MoM decline in supply. However, considering the significant increase in capacity expansion in South China, inventories are already at a high level and continue to experience inventory buildup. There is a possibility of South China cargo being diverted to the Ningbo region. Therefore, overall supply is expected to increase slightly. In terms of inventory, although this week's HRC inventory in Ningbo increased slightly compared to October 9, the total volume is nearly on par with the same period last year. Downstream end-use demand has marginally improved after the post-holiday resumption of work, but the overall strength has not met the expectations of the "October peak season". Looking ahead, downstream consumption of HRC in Ningbo is expected to increase steadily but slightly. However, considering the expected rise in supply, inventories will primarily fluctuate rangebound. Even if there is a drawdown in inventories, the magnitude will not be significant.

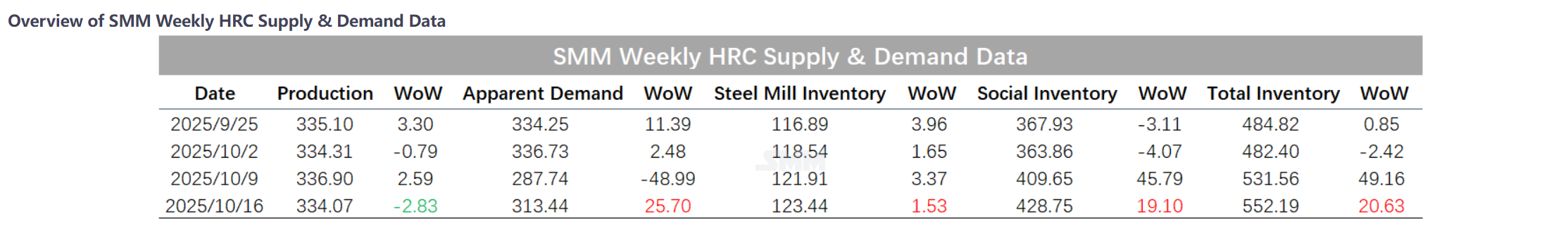

This week, SMM released its weekly HRC balance data, showing a slight MoM decline in HRC production. This week, SMM statistics indicated that the social inventory of HRC across 86 warehouses (large sample) nationwide reached 4.2875 million mt, up 191,000 mt MoM or 4.66% MoM, and up 4.66% on a new calendar year basis YoY. This week, social inventory across the country continued to accumulate, with the rate of buildup narrowing. By region, except for a slight inventory reduction in north-east China, other regions still experienced inventory buildup, with east China and north China seeing larger increases.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)